Blog

DSCR Loan Pros and Cons: A Comprehensive Guide for Smart Borrowers

Debt Service Coverage Ratio (DSCR) loans are a hot topic among real estate investors and business owners looking for creative financing options. Unlike traditional loans, DSCR loans focus on the income generated by the property rather than the borrower's personal income.

In this guide, we’ll dive into the pros and cons of DSCR loans, helping you make an informed decision.

What is a DSCR Loan?

A DSCR loan measures a property's income against its debt obligations. Lenders use the debt service coverage ratio to evaluate if the property generates enough cash flow to cover loan repayments. For example:

A DSCR of 1.25 means the property generates 25% more income than required to cover its debt obligations.

This type of loan is particularly popular in commercial real estate and with property investors managing multiple income-generating assets.

Pros of DSCR Loans

1. No Personal Income Verification

One of the most significant advantages of DSCR loans is that they do not require personal income verification. Traditional loans often demand extensive documentation, such as tax returns, pay stubs, and bank statements, to prove the borrower’s ability to repay the loan. With DSCR loans, the focus is entirely on the income generated by the property.

Who benefits: Real estate investors with complex financials or self-employed individuals with inconsistent income streams.

2. Flexible Qualification Criteria

DSCR loans are more lenient in terms of borrower eligibility. Lenders prioritize the property's DSCR rather than personal credit scores or debt-to-income ratios.

Example: If a property generates steady rental income that exceeds the loan's monthly payments, the borrower can qualify even with a low personal credit score.

3. Higher Loan Amounts

Since DSCR loans evaluate a property’s income-generating potential, properties with strong cash flows can qualify for larger loan amounts. This is particularly advantageous for investors looking to scale their real estate portfolios.

Scenario: An investor purchasing a multi-family rental property with a DSCR of 1.5 may secure higher financing compared to a single-family home with a lower DSCR.

4. Streamlined Process

The documentation requirements for DSCR loans are significantly less than traditional loans. This simplifies the application and approval process, saving time for busy investors.

Benefit: Investors can close deals faster, which is especially crucial in competitive real estate markets.

5. Tailored for Real Estate Investors

DSCR loans are specifically designed for rental and commercial properties, making them an ideal financing option for seasoned and new investors alike.

Example: Investors can use DSCR loans to purchase or refinance properties like apartment complexes, retail spaces, or office buildings without worrying about personal income restrictions.

Cons of DSCR Loans

1. Higher Interest Rates

DSCR loans often come with higher interest rates compared to traditional loans. Lenders perceive these loans as riskier because they rely solely on the property's cash flow rather than the borrower’s financial stability.

Impact: Borrowers pay more over the life of the loan, increasing overall investment costs.

Mitigation Tip: Shopping around for the best rates or improving the property’s DSCR can help reduce interest rates.

2. Larger Down Payments

DSCR loans typically require a down payment of 20–30%, which is higher than the 5–20% needed for conventional loans.

Challenge for Borrowers: Investors may face liquidity issues, especially if they need to finance multiple properties.

Example: A $500,000 property might require a $100,000 to $150,000 down payment for a DSCR loan, compared to $25,000 to $50,000 for a traditional loan.

3. Strict Property Income Requirements

Lenders assess the property’s ability to generate sufficient income to meet the debt obligations. If the property's DSCR falls below the lender’s minimum threshold (usually 1.25), the loan application may be denied.

Example: A property generating $10,000 monthly income but requiring $9,500 in monthly debt payments has a DSCR of 1.05, which might not qualify.

4. Limited Loan Providers

Not all lenders offer DSCR loans. Borrowers may need to work with niche lenders who specialize in real estate investment financing.

Impact: Limited options may result in higher costs or less favorable terms.

Mitigation Tip: Research and build relationships with multiple lenders experienced in DSCR loans.

5. Prepayment Penalties

Many DSCR loans include prepayment penalties, discouraging borrowers from paying off their loans early or refinancing.

Impact: Investors could face significant costs if they refinance to take advantage of lower interest rates or sell the property before the loan term ends.

Mitigation Tip: Carefully review loan agreements and opt for loans with flexible prepayment terms.

When Does a DSCR Loan Make Sense?

A DSCR loan is an excellent choice for:

Real estate investors focusing on income-generating properties.

Self-employed individuals who lack consistent income documentation.

Investors with multiple properties who want to avoid conventional loan caps.

Visualizing DSCR Loan Pros and Cons

DSCR Loan Comparison Chart:

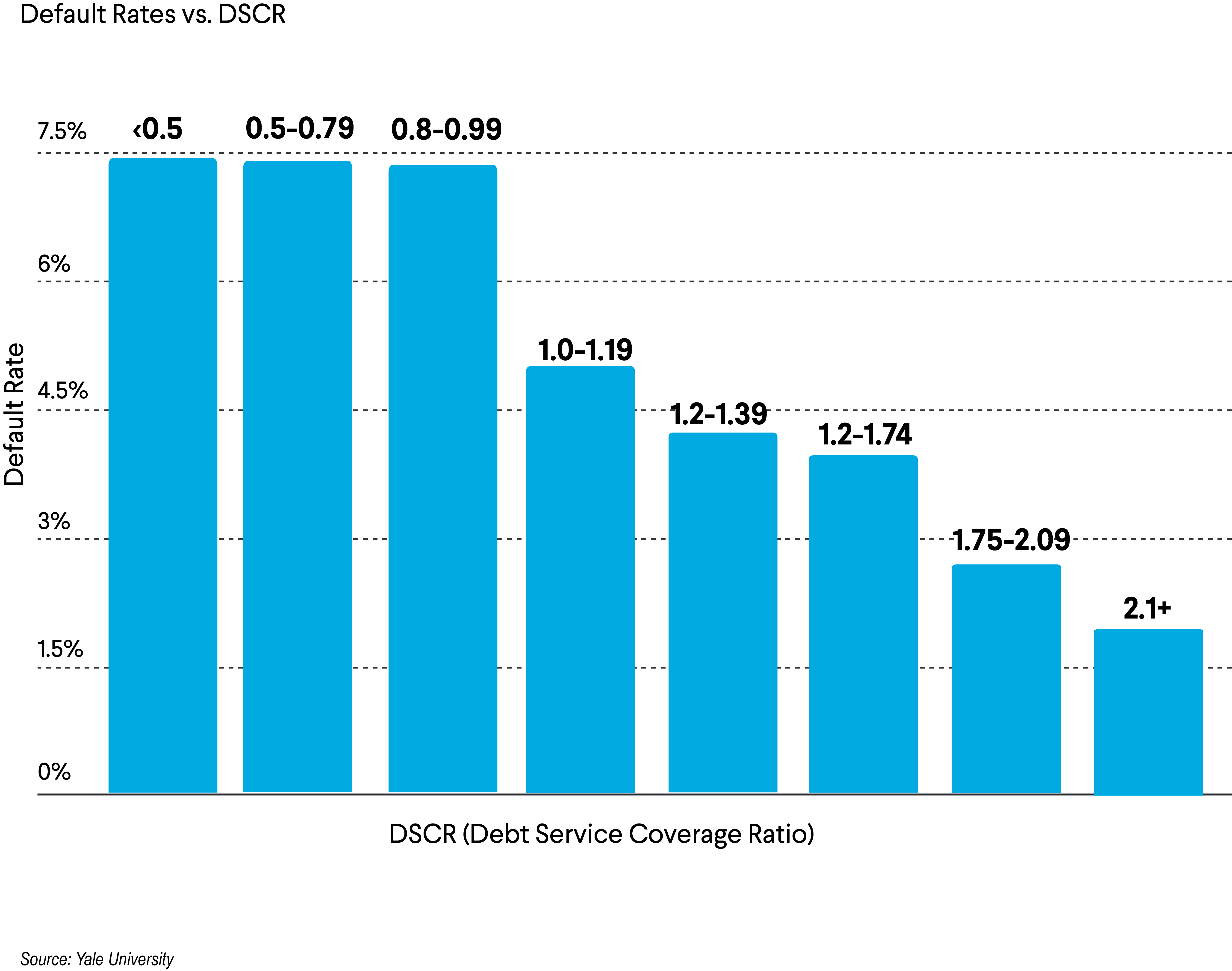

DSCR Loan Approval Rate by DSCR Ratio (Bar Graph)

The Debt Service Coverage Ratio (DSCR) is a key metric lenders use to assess a property's ability to cover its debt obligations. Generally, a higher DSCR indicates a stronger financial position, leading to a higher likelihood of loan approval.

DSCR 1.0–1.25: 70% approval rate

DSCR 1.25–1.5: 85% approval rate

DSCR > 1.5: 95% approval rate

Note: These figures are illustrative and can vary based on lender policies and market conditions.

This data underscores the importance of maintaining a DSCR above 1.25 to enhance the probability of securing a loan.

Source: https://www.omnicalculator.com/finance/dscr

Tips for Getting the Best DSCR Loan Terms

Improve Property Cash Flow: Enhance rental income or reduce operating costs to boost DSCR.

Shop Around: Compare multiple lenders to find the best rates and terms.

Understand Prepayment Penalties: Ensure you’re clear on the loan terms to avoid hidden fees.

Prepare Thorough Documentation: While minimal, having property financials ready can speed up approval.

Conclusion

Understanding the DSCR loan pros and cons is crucial for any investor. These loans offer unique advantages, especially for those with income-generating properties, but they come with higher costs and stricter requirements.

By carefully evaluating your property’s financials and shopping around for the best deal, you can maximize the benefits of DSCR loans while minimizing potential drawbacks.

FAQs About DSCR Loans

1. What is a DSCR loan, and how does it work?

A DSCR loan is a type of financing where lenders evaluate the property’s income (rather than the borrower’s personal income) to ensure it can cover the loan's debt payments.

2. Who is eligible for a DSCR loan?

DSCR loans are ideal for real estate investors, self-employed individuals, or anyone with income-generating properties that meet the lender’s DSCR requirements.

3. What is a good DSCR ratio to qualify for a loan?

A DSCR of 1.25 or higher is typically considered strong, indicating the property generates 25% more income than required to cover its debt obligations.

4. What are the main advantages of a DSCR loan?

Key benefits include no personal income verification, flexible qualification criteria, faster approval, and higher loan amounts for income-generating properties.

5. What are the downsides of a DSCR loan?

Drawbacks include higher interest rates, larger down payments, limited lender availability, and potential prepayment penalties.

Read More:

Hard Money Loans Requirement: Essential Guide for Property Investors

Understanding the Market Value of Land: A Comprehensive Guide for Property Investors

What Is Table Funding? Definition, Benefits, and How It Works

Disclaimer: Loans only apply to non-owner occupied properties. Rates, terms and conditions offered only to qualified borrowers, may vary upon loan product, deal structure, other applicable considerations, and are subject to change at any time without notice.

Copyright © 2025. All Rights Reserved.